If you’re eligible, you could be two months away from receiving your first child tax credit payment from the IRS! An announcement was made this week stating that checks would start to be distributed on July 15th. Eligible parents can receive up to $300 a month per child.

According to President Biden, 9 out of 10 families with children in the United States will qualify for the tax credit. Starting in July, all the way through December, you will receive half of your payments, with the remaining amount arriving with your tax refund in 2022.

How much is being given in total?

The child tax credit is capped at $3,600 per child.

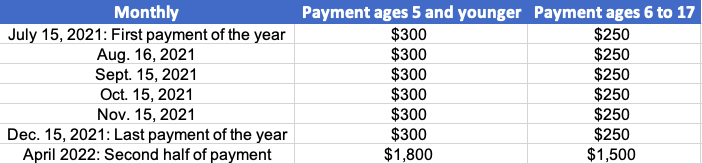

Below is the provided timeline for the child tax credit payments:

Note: that the amount you will receive gets phased out for people in higher income brackets. Singles making more than 75K per year, heads of households making more than 112.5K per year, and couples earning more than 150K per year. These parties’ child tax credits will begin to phase out by $50 for every 1K of income above those thresholds.

For example, if your income (individual) is less than $75K and you have one child younger than 6 years old, you’ll qualify for $3,600. Kids ages 6 through 17 will count for up to $3K each. Kids who are under the age of 6 can count for up to $3.6K each.

The IRS is opening up portals for your viewing

On July 1st, the IRS is opening up two portals on their website where you will be able to update your income and dependents’ information. Additionally, you will have the option to opt-out of receiving monthly payments and instead receive a single, comprehensive check-in 2022. That means rather than receiving monthly payments, you can wait until you file your 2021 taxes to receive the full $3,600 in a one-time payment.

That being said, below are some commonly asked questions we’ve received from clients:

What if I don’t normally file taxes?

The IRS is opening the second portal dedicated to people who do not typically file income taxes. This will allow you to provide the IRS with all the necessary information (number of dependents, income, etc).

What If I already filed my taxes?

Per the IRS, you must file your 2020 taxes to get the credit. The IRS will automatically deposit payments for those who filed their taxes by May 17th. No additional steps are necessary. However, If you do not have your taxes submitted by this date, you must provide the IRS with the required information to receive your payment.

Are children over 17 eligible?

Dependents aged 18 will qualify for up to $500 each toward the child tax credit. If you have a dependent between the ages of 19 and 24 who attends college full-time, they can qualify for up to $500 each toward your overall payment, per the new stimulus bill.

Whats Next?

If you’ve already filed your taxes… sit back and relax. The IRS will automatically begin distributing funds in the next few weeks. If you have not paid your taxes, keep a lookout for the IRS portals that will be opened up shortly, and make sure that you either file your taxes, or upload the proper information as requested by the IRS.

Sign up for our free newsletter or follow us on social media to stay up to date on the latest tax news!

If you need help or have additional questions, feel free to book a call and talk to an expert!