Given that we are in the midst of what many financial analysts describe as the “crypto craze”, we figured it would be helpful to outline some of the tax implications that come along with buying and selling cryptocurrencies. The one topic nobody wants to think about while watching their bitcoin rise is… Cryptocurrency taxes.

Whether you are buying bitcoin and holding, or day trading various “alt-coins” , it is critical to understand the tax implications that come with it.

How are cryptocurrencies taxed? (USA)

Below are the different scenarios that the IRS classify as “taxable events”:

– Trading cryptocurrency to fiat currency like the US dollar (Selling your Crypto)

– Trading one cryptocurrency for another cryptocurrency (Swapping)

– Spending cryptocurrency to purchase goods or services (Purchases)

– Earning cryptocurrency as income (Airdrops, Staking, Etc)

The federal tax rate on crypto ranges from 0%-37%, with your specific rate varying based on a variety of factors, such as:

- The duration which you held the cryptocurrency

- Your overall annual income (including non-crypto sources such as W-2) and tax filing status.

- The accounting method used for calculating gains and losses

How Much Will I Have to Pay In Taxes?

In the United States, the amount of capital gains tax you pay is dependent on your income level as well as your marital status. Additionally, it depends on how long you’ve held your asset.

In the states this is split into two parts:

Short Term Capital Gains:

Any gains or losses made from a cryptocurrency held less than one year will be taxed at the same rate as whatever income tax bracket you’re in. A full list of tax brackets for 2020-21 can be found here. Any losses can be used to offset income tax by a maximum of $3,000, just like your typical equities. Any further losses can be carried forward as previously mentioned.

Long Term Capital Gains:

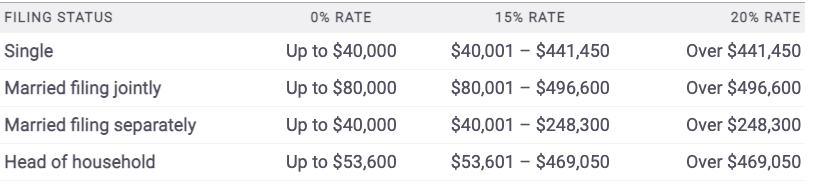

Any gains or losses made from a crypto asset held for longer than a year incurs a much lower 0%, 15% or 20% tax depending on individual or combined marital income.

Depending on whether you are filing jointly or as an individual, any gains or losses from a crypto asset kept for more than a year are taxed at a much lower rate of 0%, 15%, or 20%.

2020 Long Term Capital Gains Tax

2021 Long Term Capital Gains Tax

When do I not get taxed on crypto?

In certain instances, you will not trigger any taxable events when transacting with crypto, and you will not have to pay or report any cryptocurrency taxes.

You do not trigger a taxable event when you:

- Buy & hold cryptocurrency

- Transfer cryptocurrency from one wallet that you own to another wallet you own

Preparing for Crypto Tax Season

The more organized you are, the easier things will be when it comes time to pay taxes on your cryptocurrency gains. Here are some of the things you can do in the meantime:

Keep a record of all your transactions

The IRS requires that all cryptocurrency users keep an accurate record of all relevant transactions. This includes buying, selling, airdrops, interest income, and all other activities classified as capital gains income by the IRS.

Consider the tax implications when transacting

When choosing to sell, trade, or swap your crypto, make sure to take into account your personal tax situation and the implications of the transaction. Remember that the length of time you hold the crypto, your income tax bracket, and your marital status are factors that impact the amount of money you will owe.

Talk to an Expert

When in doubt, it’s best to leave the hard work to a tax professional who will help you maximize your savings and develop the optimal strategy that works for YOUR situation.

To learn more about the importance of having a plan, read our article on Tax Planning