In the simplest sense, a tax deduction is an expense that a business or taxpayer can deduct from their adjusted gross income when filing their forms. This expense reduces your taxable income, and in turn, reduces the amount of money you owe in taxes.

Taxpayers generally have two options:

- Use the standard deduction

- Fill out an itemized list of your deductible expenses

Meet with your accountant or advisor in order to decide which route is the best for you. Ensuring that you make the most out of your deductions each year could save you tens, and even hundreds of thousands a year in owed income.

Keeping track of your deductions

Running a small business and keeping track of every single expense can be a cumbersome, and sometimes impossible task. That’s the exact reason that many growing businesses opt to work with a bookkeeper. A proper bookkeeping partner will help you keep all of your financial documents organized, up-to-date, and accessible when you need them.

In order to claim your deductions, you will need to have kept a proper record of all of your transactions, including small expenses. If you need help keeping tabs on your business’s financial life, give us a call!

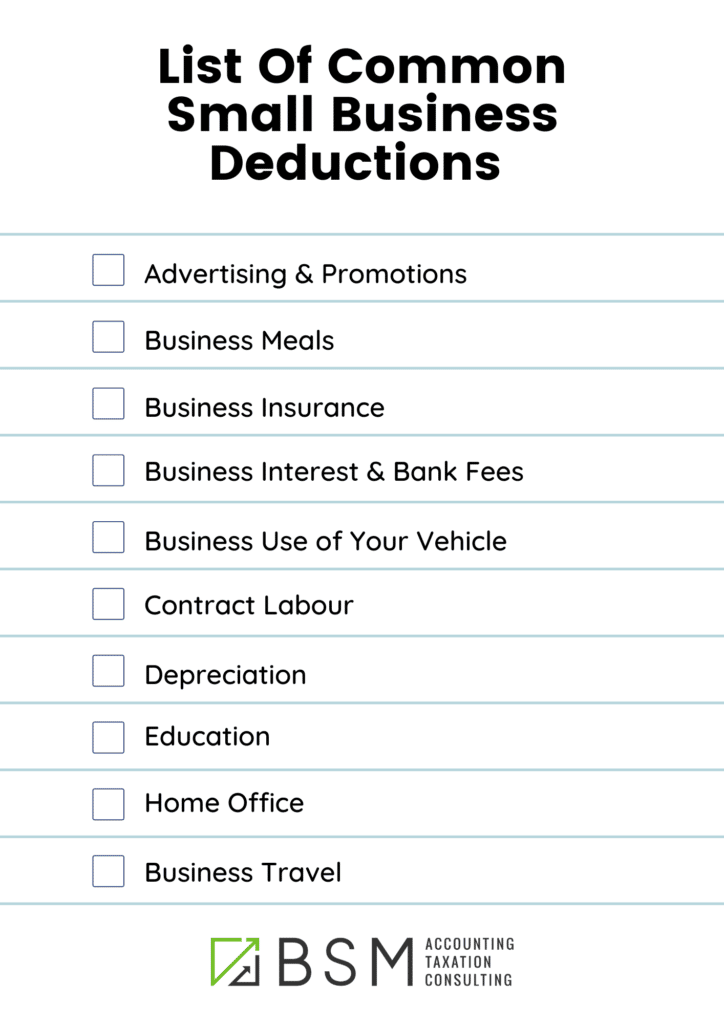

In the meantime, check out this shortlist below of the most common small business deductions:

Book a call with one of our experts for help with tax filing this year! In the meantime, check out our latest Forbes article on why tax planning could make or break your business!